Personal Finance Write For Us

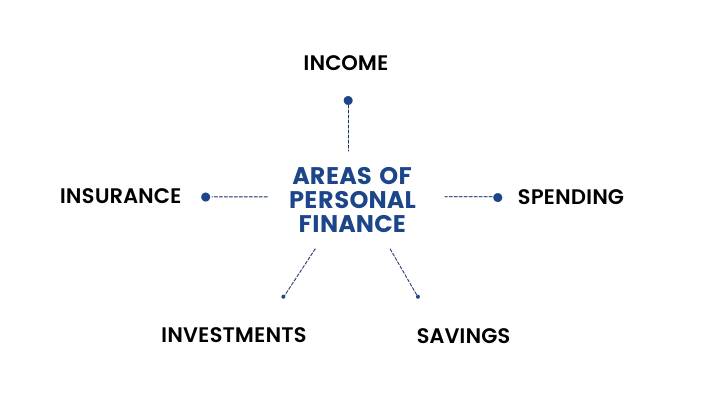

Personal Finance Write For Us – Personal finance is designing and managing individual financial actions such as income group, spending, saving, investing, and protection. And also, the course of managing one’s finances can be short in a budget or financial plan. Therefore, this guide will examine the most common and essential aspects of personal financial management.

Where Should I Put my Reserves?

However, it is logical to set up separate savings or overnight accounts for your savings to avoid the temptation not to spend them without a valid reason. And also, the advantage of such an account is that the money remains available promptly. Saving the emergency fund should take precedence over all other financial intentions and should also be evaluated regularly to be able to make adjustments: For example, someone who barely owns expensive equipment does not need as many reserves as someone who has several expensive and aging items that need to be changed or repaired soon. Therefore, as a guideline, you should put around 10 percent of your monthly net income on the high edge.

Get an Overview of your Finances and Draw Up a Budget

This point can fulfill relatively quickly, as many banks nowadays have a function of listing the expenses for you. That is a great way to understand where the money is going and reflect on whether these expenses are worthwhile. The consequence of this is that you learn to set up a budget to keep such expenses in check and adjust them. A great help when drawing up a budget is either classic self-created Excel tables or apps specializing in finance.

Pay Bills and Installments on Time

It should be automat: If recurring bills, such as rent, internet, or electricity, are pending, standing orders recommend. So you don’t have to consider it every month and avoid both an accumulation of unnecessary debts and costs and a deterioration in your Schufa rating. One-off bills should, of course, paid immediately to avoid late payment surcharges and similar fees.

Invest the Money that is Left Over

If you have any money missing over after the nest egg and your livelihood, you should invest it. There is little point in leaving the money in your account when you can instead make it work for you through buying stocks or ETFs. Because although the 2019 pension insurance report states that pensions will increase by 36.5 percent by 2033, you should take care of your retirement provision as well. However, before you take this step, please read up on the material or seek advice from someone who already experiences it.

Clean Up and Buy Used

And also, if you have items that you don’t need, online marketplaces use them to sell them. It is also an excellent idea for bargain hunters to buy used items, as these are often much cheaper. In most cases, you only have to accept a minimal loss of quality, which is often optical. That saves you money when you buy a new table, car or bike. It is best to check online before every major new purchase to see whether it is also cheaper. The buying and selling of used items are also more sustainable and therefore environmentally friendly.

How to Submit Your Articles?

To submit guest posts, please study through the guidelines mentioned below. You can contact us finished the website contact form or at contact@marketing2business.com

Why Write for Marketing2Business – Personal Finance Write For Us

- If you write to us, your business is targeted, and the consumer can read your article; you can have huge exposure.

- This will help in building relationships with your beleaguered audience.

- If you write for us, the obvious of your brand and contain worldly.

- Our presence is also on social media, and we share your article on social channels.

- You container link back to your website in the article, which stocks SEO value with your website.

- You can send your article to contact@marketing2business.com

Search Terms Related to Personal Finance Write for Us

- Behavioral Finance

- Budgeting

- Consumer Protection

- Credit Score

- Debt Management

- Emergency Fund

- Estate Planning

- Financial Goals

- Financial Literacy

- Financial Planning

- Financial Wellness

- Impact Investing

- Insurance

- Investing

- Retirement Planning

- Risk Management

- Saving

- Sustainable Finance

- Taxes

- Wealth Management

Search Terms for Write For Us

Personal Finance Write for us

Guest Post Personal Finance

Contribute Personal Finance

Personal Finance Submit post

Submit an article on Personal Finance

Become a guest blogger at Personal Finance

Personal Finance writers wanted

Suggest a post on Personal Finance

Personal Finance guest author

Article Guidelines on Marketing2Business – Personal Finance Write For Us

- The author cannot be republished their guest post content on any other website.

- Your article or post should be unique, not copied or published anywhere on another website.

- The author cannot be republished their guest post content on any other website.

- You cannot add any affiliates code, advertisements, or referral links are not allowed to add into articles.

- High-quality articles will be published, and poor-quality papers will be rejected.

- An article must be more than 350 words.

- You can send your article to contact@marketing2business.com